Finding reliable blind suppliers in China feels overwhelming. I've watched countless buyers struggle with quality issues, missed deadlines, and hidden costs.

China manufactures over 85% of global window blinds[^1], offering 40-60% cost savings compared to Western suppliers, with MOQs starting from 50 pieces and lead times of 15-25 days.

After 15 years in this industry, I've learned that successful China sourcing isn't about finding the cheapest price. It's about understanding the ecosystem, building relationships, and knowing exactly what questions to ask. Let me share what I've discovered through thousands of orders and dozens of factory visits.

Why Source Window Blinds from China?

The cost difference stops many buyers in their tracks. A motorized roller blind that costs $180 in the US often sells for $65-80 from Chinese factories.

Chinese manufacturers[^2] offer 40-60% lower prices than Western suppliers due to integrated supply chains, lower labor costs ($500-800/month vs $3000-5000), and economies of scale with annual production exceeding 500 million units.

I remember my first sourcing trip to Guangdong in 2009. Walking through the Foshan blinds manufacturing cluster opened my eyes to why China dominates this market. Within a 50-kilometer radius, I found aluminum extruders, fabric weavers, motor manufacturers, and assembly plants. This vertical integration creates unbeatable advantages.

The numbers tell the story clearly. Chinese factories produce 85% of global window blinds, with Zhejiang and Guangdong provinces accounting for 70% of exports. Labor costs remain 70-80% lower than Western countries. Raw material suppliers cluster around manufacturing hubs, reducing logistics costs by 30-40%. Most importantly, Chinese factories invested heavily in automation over the past decade, improving quality consistency while maintaining price advantages.

| Cost Component | China Factory | US/EU Factory | Savings |

|---|---|---|---|

| Labor (per unit) | $3-5 | $15-25 | 70-80% |

| Raw Materials | $15-20 | $25-35 | 40-43% |

| Overhead | $5-8 | $20-30 | 73-75% |

| Total Unit Cost | $23-33 | $60-90 | 62-63% |

Beyond pure cost, Chinese suppliers offer flexibility that Western factories can't match. They accept smaller MOQs for custom colors (often 50-100 pieces), provide free sampling for serious buyers, and accommodate special requirements like non-standard sizes or unique mounting systems. The speed impresses me most - custom orders ship in 15-25 days compared to 6-8 weeks from European factories.

Quality concerns used to be valid, but the landscape changed dramatically. Top-tier Chinese factories now hold ISO 9001, CE marking, and BSCI certifications. They use the same Somfy and Dooya motors found in premium Western brands. Many export 80% of production to demanding markets like Germany, Australia, and the US, meeting strict safety and performance standards.

How to Choose Reliable Window Blinds Suppliers?

Choosing the wrong supplier costs more than money. I've seen projects fail because factories couldn't deliver consistent quality or meet deadlines.

Reliable suppliers demonstrate 5+ years of export experience, hold international certifications (ISO 9001, CE, BSCI), maintain showrooms with 100+ samples, provide English-speaking project managers, and show verified export records to your target markets.

My supplier evaluation system evolved through trial and error over 15 years. I start by examining export experience - not just years in business, but specific experience with your target market. A factory selling to Africa operates differently than one serving European distributors. Request shipping documents, customer references, and case studies from similar projects.

Certifications matter, but understanding which ones takes expertise. ISO 9001 indicates quality management systems. CE marking proves European safety compliance. BSCI audits verify social responsibility. Child safety certifications like EN 13120 or ANSI/WCMA become critical for residential projects. I always request certification copies and verify them through official databases.

| Certification | What It Proves | Why It Matters |

|---|---|---|

| ISO 9001 | Quality management system | Consistent production standards |

| CE Marking | EU safety compliance | Legal requirement for Europe |

| BSCI | Social responsibility | Ethical sourcing verification |

| EN 13120 | Child safety standards | Residential project requirement |

| SGS Testing | Material safety | Chemical compliance proof |

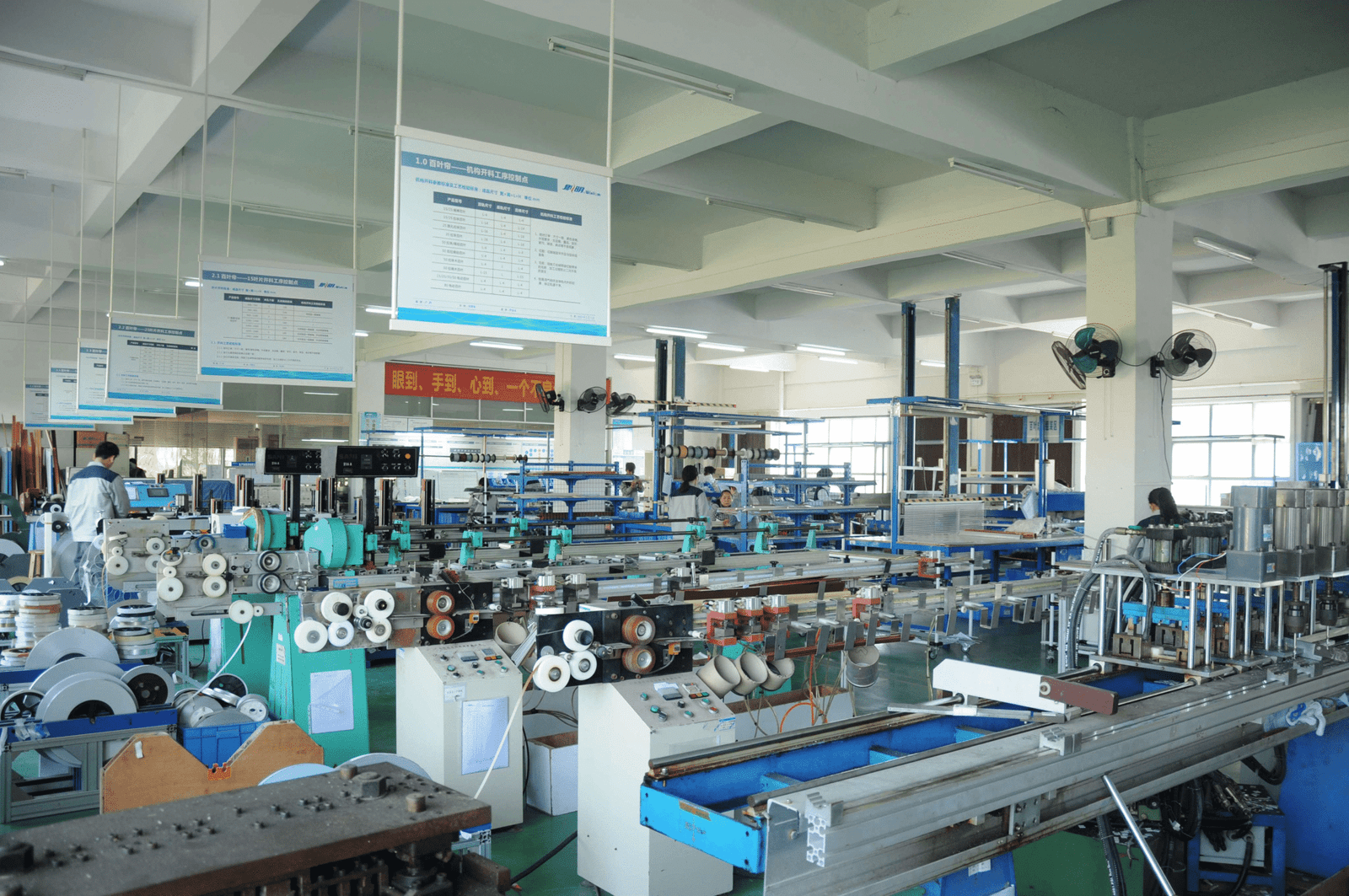

Production capacity tells you if they can handle your growth. I look for factories with 50+ workers, multiple production lines, and monthly capacity exceeding 50,000 square meters. Smaller operations might offer lower prices but struggle with large orders or tight deadlines. Ask about their biggest clients and current capacity utilization.

Communication quality predicts project success. Professional suppliers assign English-speaking project managers, respond within 24 hours, and provide detailed technical drawings. They proactively share production updates, quality control photos, and shipping schedules. Red flags include poor English, delayed responses, or reluctance to share factory information.

Financial stability matters for long-term partnerships. I check business licenses, verify registered capital (minimum $500,000 USD), and review Dun & Bradstreet reports when available. Established suppliers offer payment terms like 30% deposit and 70% before shipping. New or weak factories demand 50-70% upfront, indicating cash flow problems.

What Are the Key Factory Audit Criteria?

Factory visits reveal truth that websites hide. I've audited over 50 blinds factories and developed a systematic approach.

Key audit criteria include production capacity (minimum 30,000 sqm/month), quality control systems (incoming/in-line/final inspection), worker conditions, raw material sourcing, testing equipment, sample rooms, inventory management, and environmental compliance.

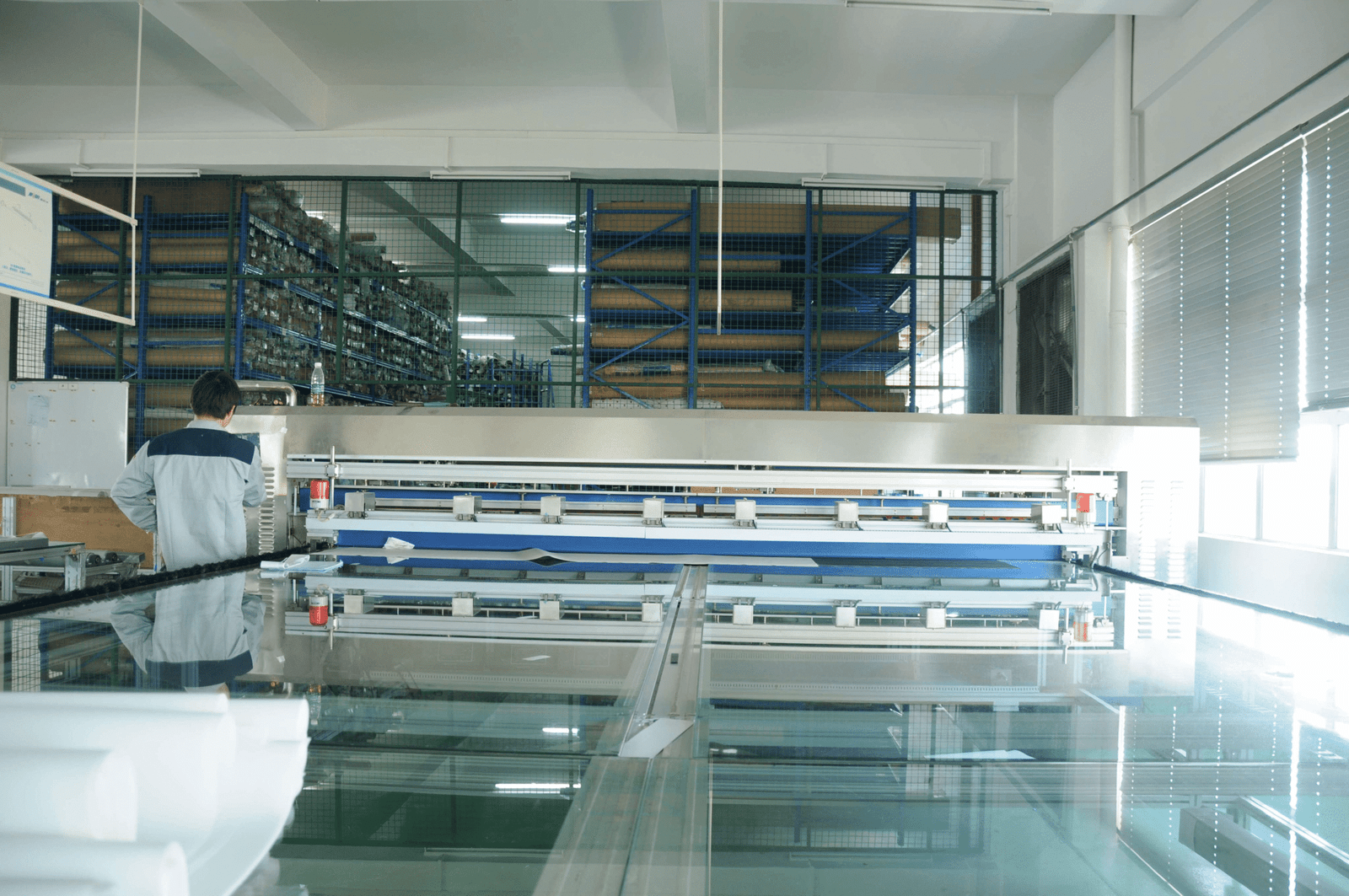

Production flow analysis starts at raw material storage. Professional factories maintain 15-30 days of material inventory, protecting against supply disruptions. I check aluminum profile quality, fabric roll storage conditions, and component organization. Proper material handling prevents defects before production begins. Temperature and humidity control in fabric storage areas indicates attention to quality.

The cutting and fabrication area reveals operational efficiency. Modern factories use CNC cutting machines for precision, maintaining tolerances within 1mm. I measure waste rates - efficient operations keep fabric waste below 5% and aluminum waste under 3%. Worker skill levels show through clean cuts, proper handling, and organized workstations. Each station should have quality standards posted and measuring tools readily available.

| Audit Area | What to Check | Red Flags |

|---|---|---|

| Material Storage | Organization, climate control, FIFO system | Dusty conditions, mixed batches |

| Cutting Area | CNC equipment, waste rates, precision | Manual cutting, high waste |

| Assembly Line | Work instructions, quality checks, flow | Rushed work, no inspections |

| Testing Lab | Equipment calibration, test records | Missing equipment, no records |

| Packaging | Protection methods, labeling, inspection | Minimal protection, errors |

Quality control systems separate professional suppliers from commodity producers. I verify three inspection levels: incoming material inspection (IQC), in-process quality control (IPQC), and final quality control (FQC). Each stage needs documented procedures, trained inspectors, and rejection criteria. Testing equipment should include tension testers for fabrics, durability testers for mechanisms, and color matching booths.

Worker conditions reflect company values and stability. Fair wages, clean facilities, and proper safety equipment indicate a sustainable supplier. I note worker turnover rates - below 5% monthly suggests good management. Training programs, skill certifications, and promotion paths show investment in quality. Factories treating workers well produce better products with fewer defects.

Environmental compliance becomes increasingly important. I check for wastewater treatment systems, VOC emission controls, and waste recycling programs. Leading factories hold ISO 14001 environmental certification and provide sustainability reports. Energy-efficient lighting, solar panels, and heat recovery systems indicate forward-thinking management aligned with global trends.

What Are the Typical MOQ, Lead Time, and Payment Terms?

Understanding Chinese suppliers' business terms prevents costly surprises. Each term interconnects with others, affecting your total project cost.

Standard terms include MOQ of 50-100 pieces per SKU for stock items (500+ for custom colors), lead times of 15-25 days for standard orders (30-45 days for custom), and payment terms of 30% deposit with 70% before shipping via T/T.

MOQ varies dramatically based on customization level. Stock colors in standard sizes start at 50 pieces, making small projects feasible. Custom colors jump to 500-1000 pieces

because factories must order full fabric rolls or schedule special dyeing batches. Special sizes or mechanisms might require 200-300 pieces minimum. I negotiate MOQs by combining similar items, accepting longer lead times, or paying 10-15% premiums for flexibility.

Lead time calculations involve multiple factors beyond simple production. Material preparation takes 3-5 days for stock items or 10-15 days for custom materials. Production requires 1-2 days per 1000 pieces on modern lines. Quality control and packaging add 2-3 days. International shipping adds 25-35 days by sea or 7-10 days by air. Chinese holidays like Spring Festival or Golden Week can extend timelines by 2-3 weeks.

| Order Type | MOQ | Lead Time | Typical Payment |

|---|---|---|---|

| Stock Items | 50-100 pcs | 15-20 days | 30/70 T/T |

| Custom Size | 100-200 pcs | 20-25 days | 30/70 T/T |

| Custom Color | 500-1000 pcs | 30-35 days | 30/70 or 50/50 T/T |

| OEM Products | 1000+ pcs | 45-60 days | 30/70 L/C accepted |

Payment terms reflect supplier confidence and cash flow needs. Established factories accept 30% deposits, while newer suppliers might demand 50%. I prefer T/T (telegraphic transfer) for amounts under $50,000 due to low fees and fast processing. Letters of credit work for larger orders but add 2-3% in bank fees. Some suppliers accept PayPal for samples but add 4-5% to cover transaction costs.

Hidden costs impact total landed cost significantly. Chinese factories quote EXW (ex-works) or FOB (free on board) prices. Add freight forwarding ($200-400 per CBM), customs clearance ($150-300), import duties (3.9-6.5% for blinds), inland transportation, and potential storage fees. Air freight costs 5-8 times more than sea freight but saves 3-4 weeks. I budget 25-35% above FOB price for total landed cost.

Negotiation strategies depend on understanding supplier motivations. Factories prefer larger orders, consistent business, and predictable scheduling. I secure better terms by committing to annual volumes, accepting flexible delivery dates, or ordering during slow seasons. Paying deposits quickly, maintaining clear communication, and building relationships yield 5-10% additional discounts over time.

What Blinds Types Are Most Suitable for Export Buyers?

Product selection determines project success more than any other factor. After managing hundreds of international projects, I've identified clear winners and losers.

Roller blinds, zebra blinds, and motorized systems dominate export markets, accounting for 75% of orders due to universal appeal, easy installation, competitive pricing ($15-50 FOB), and minimal shipping volume (100 pieces per CBM).

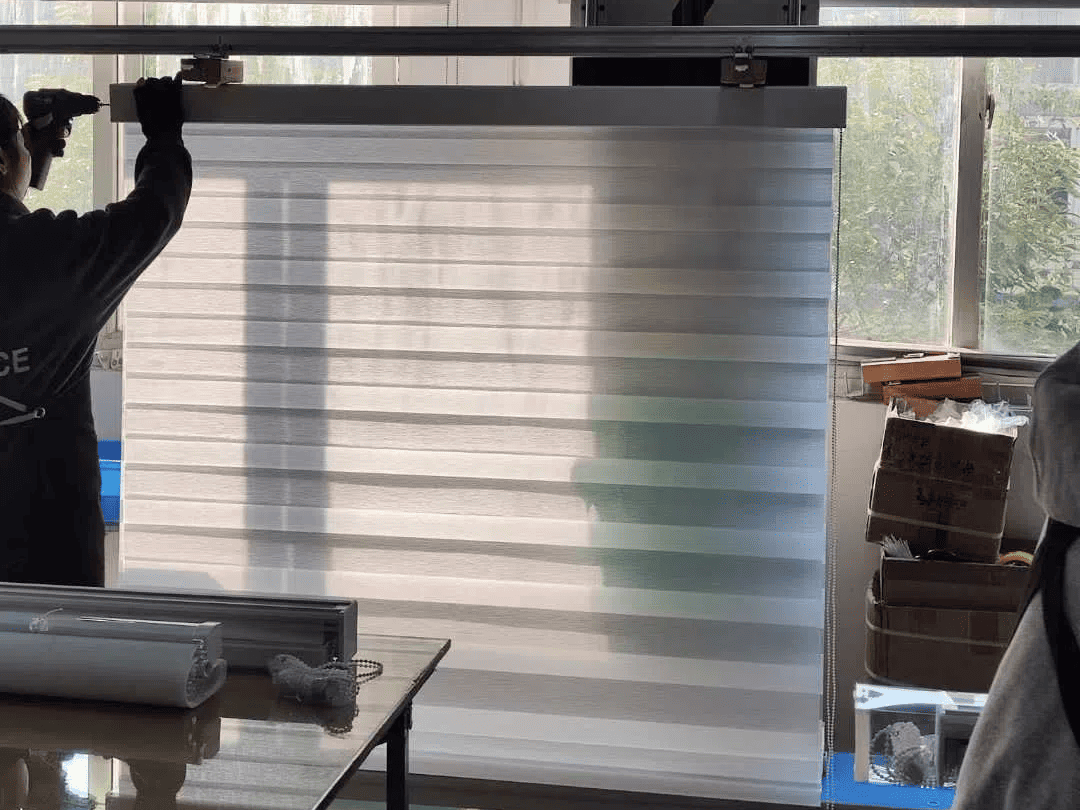

Roller blinds remain the export champion for solid reasons. Simple mechanisms reduce failure rates below 0.5%. Installation takes 10-15 minutes without special tools. Fabric choices range from blackout (100% light blocking) to solar screen (maintaining outside views). Shipping efficiency impresses - pack 100-150 pieces per cubic meter. Price points from $15-40 FOB fit most project budgets. Customization options include digital printing, allowing unique designs without huge MOQs.

Zebra blinds (day-night blinds) exploded in popularity since 2018. The alternating sheer and solid stripes offer variable light control without complex mechanisms. Chinese factories mastered production efficiency, dropping prices 50% in five years. Current FOB prices range $20-45 for standard sizes. Installation simplicity matches roller blinds. European and Middle Eastern markets show 40% annual growth. I recommend 100% polyester fabrics for durability and UV resistance.

| Blind Type | FOB Price | Packing Density | Installation Time | Market Growth |

|---|---|---|---|---|

| Roller | $15-40 | 100-150 pcs/CBM | 10-15 min | 15% annually |

| Zebra | $20-45 | 80-120 pcs/CBM | 10-15 min | 40% annually |

| Motorized | $65-150 | 60-80 pcs/CBM | 20-30 min | 60% annually |

| Venetian | $25-60 | 40-60 pcs/CBM | 15-20 min | 5% annually |

| Vertical | $30-70 | 30-50 pcs/CBM | 20-30 min | -5% annually |

Motorized systems represent the future of window coverings. Integration with smart home systems like Alexa, Google Home, and Apple HomeKit drives demand. Chinese factories partnered with Somfy, Dooya, and Brel to offer reliable motors at competitive prices. Battery-powered options eliminate rewiring needs. I see 60% annual growth in motorized blinds, especially for commercial projects. Prices dropped from $200+ to $65-150 FOB, making automation accessible.

Product selection mistakes cost money and reputation. Avoid wooden blinds for international shipping - humidity changes cause warping, and fumigation requirements add costs. Vertical blinds lost popularity due to tangling issues and dated appearance. Roman shades require careful handling and custom packaging, increasing shipping costs 40%. Pleated blinds work well in Europe but fail in humid climates.

Market-specific preferences guide product mix. North American buyers prefer cordless systems for child safety. European markets demand precise measurements and high-quality components. Middle Eastern clients favor blackout fabrics and motorization. Australian regulations require specific UV ratings and fire retardancy. I maintain different product lines for each major market, optimizing specifications and pricing accordingly.

Conclusion

Sourcing blinds from China offers unmatched value when you understand the system, choose partners carefully, and manage projects professionally.

Extended FAQ Section

How do I verify Chinese blind factory certifications are authentic?

Verifying factory certifications requires systematic checking across multiple databases and direct confirmation with issuing bodies. I start by requesting high-resolution copies of all certificates, checking for security features like holograms, unique serial numbers, and official stamps. ISO certificates include QR codes linking to online databases where you can verify validity, scope, and expiration dates.

For CE marking, I access the European Commission database to confirm the notified body number and test report details. Each CE certificate should reference specific EN standards like EN 13120 for child safety or EN 14501 for thermal performance. BSCI audits appear in the Amfori database - request the DBID number from suppliers to check audit results, corrective actions, and validity periods. SGS, TÜV, and Bureau Veritas maintain online verification systems where certificate numbers reveal test parameters, factory details, and compliance status.

Red flags include certificates without reference numbers, expired dates, or scope limitations excluding your products. Some factories show certificates for sister companies or outdated versions. I maintain a checklist covering issuing body legitimacy, certificate scope matching your products, valid dates, and consistency between company names. Professional suppliers willingly provide certificate numbers for independent verification

---

[^1]: Explore this link to understand the advantages of sourcing window blinds from China, including cost savings and quality improvements.

[^2]: Discover how Chinese manufacturers maintain high quality standards in window blinds production, ensuring reliability and performance.Partner with VelaBlinds for Your Next Project

Smart window treatments shouldn't be complicated. After working with 500+ distributors and contractors worldwide, I've streamlined the process to get you quality products, competitive pricing, and reliable support - every time.

Why project professionals choose VelaBlinds:

- ✅ Fast, Accurate Quotes - Detailed specs and pricing within 24 hours

- ✅ Transparent Pricing - No hidden fees, volume discounts clearly outlined

- ✅ Quality Assurance - Direct partnerships with certified OEM manufacturers

- ✅ Project Support - Dedicated account manager from quote to delivery

Start your next project:

📧 Quick Quote: Send your requirements to info@velablinds.com

📱 Direct Contact: WhatsApp +86 137 2012 8317

🌐 Browse Solutions: https://velablinds.com/

📁 Product Resources: Access spec sheets, catalogs & project files

Jimmy Chen, Founder

"I built VelaBlinds to solve the real challenges I faced as a project buyer - long lead times, unclear specs, and unreliable suppliers. Let's discuss how we can power your projects with smarter blinds."

Serving distributors and contractors across North America, Europe, and Australia since 2018.