Global trade tensions and new tariffs are sending window blind import costs soaring, and project buyers need solutions to protect their margins.

Blinds and shades are subject to multiple tariffs and import duties in both the US and EU, with rates typically ranging from 6% to 25% depending on country of origin, material, and evolving trade policies. Careful sourcing and strategic planning are now essential for cost control.

Explore our full range of 👉 Venetian Blinds

Global tariff trends are reshaping the blinds market. Let's break down exactly how blinds are impacted, what rates apply, and actionable steps you can take to adapt—whether you’re a design firm, contractor, or procurement specialist. Every detail matters when margins are getting squeezed and clients expect value and transparency. Here’s my direct breakdown:

Are blinds affected by tariffs?

Every major window blind category—roller shades, honeycomb, wood, aluminum, and motorized—now faces tariffs or import duties in the US/EU. Raw materials, finished goods, and even key components like motors and fabrics are all subject to rates that can significantly drive up overall procurement costs.

Blinds, shades, and related window treatments are currently affected by import tariffs in both the US and EU, with duties applied to finished products and key components imported from China, Mexico, Canada, and Europe.

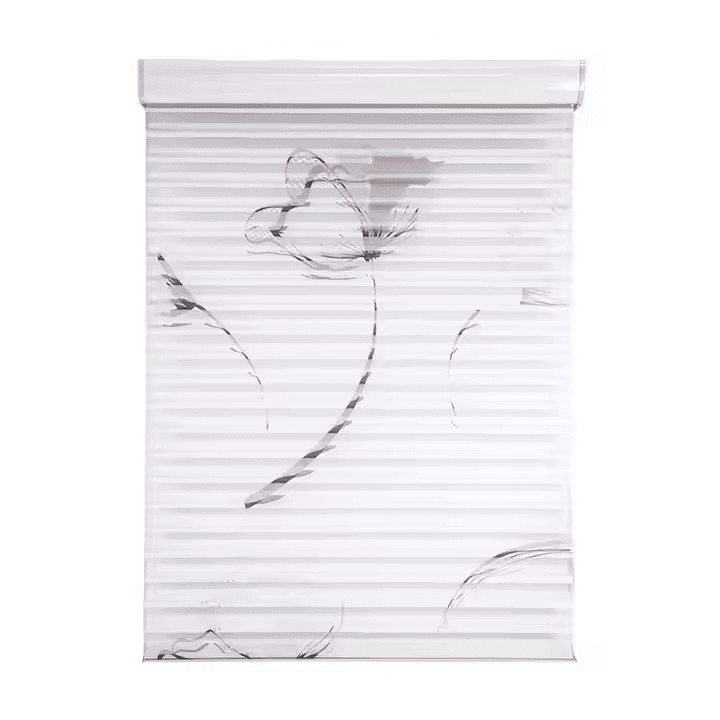

Explore our full range of 👉 Roller Shades

Technical and Market Analysis

| Product Type | US Tariff Rate (Typical) | EU Tariff Rate (MFN) | Notes |

|---|---|---|---|

| Basic Blinds/Shades | 10%-25% (esp. China/EU) | 6.9%-12% | Rate varies by HS code, origin, and product finish |

| Motorized Components | 10%-25% | 6.9%-12% | Motors, batteries often from offshore suppliers |

| Fabrics/Raw Materials | 10%-25% (if imported) | 6.9%-12% | Most synthetic fabrics are not US/EU-made |

| US-Made Blinds | 0% | n/a | If all components sourced locally |

Tariffs do not just apply to completed blinds. Imported clutches, motors, aluminum tubes, and electronics all typically see additional duties. If you source finished shades from Vietnam, South Korea, or Malaysia, the rates may be lower, but global supply chains rarely allow for complete avoidance—especially on large projects. Custom’s classification (by the HS code, often 6303.92.xx) determines the exact rate.

How do current tariffs affect window blind import costs[^1]?

New US tariffs (2025) apply a surcharge of 10-25% on finished blinds and components from China, the EU, and sometimes other nations. Many manufacturers immediately passed these costs onto distributors and project buyers, leading to wholesale price increases of 8-15%—and in some cases, even higher markups for the end customer.

Current tariffs are raising the landed cost of importing window blinds by 8-15% on average, with substantial pass-through to project pricing and reduced profit margins for buyers and contractors.

Cost Impact Breakdown

- Wholesale Price Increases: Distributors report MSRP surcharges and price list updates of 8-15% following new 2025 tariffs. In my own quoting, every new shipment from Asia or the EU now notes a specific tariff line item.

- End Customer Pricing: Increased import and logistics costs are being reflected in project proposals, often with transparent breakdowns for clients to justify cost overruns.

Example Calculation:

| Item | Previous Landed Cost | New Landed Cost (post-tariff) |

|---|---|---|

| Standard Roller Blind (per m²) | $22 | $25 (+15%) |

| Motorized System Add-on | $50 | $58 (+16%) |

- Administrative Overhead: Importers are investing more in compliance and documentation, sometimes increasing legal and processing fees by hundreds of dollars per shipment.

What tariff rates apply to blinds[^2] from China, EU, and other countries?

US and EU customs apply tariffs based on the country of origin, material, and finished product HS code.

US duties on window blinds from China can reach 25%, while EU tariffs generally fall between 6.9% and 12% for synthetic textile blinds. Blinds from US-based factories remain tariff-free, but local component shortages make all-local sourcing difficult on most projects.

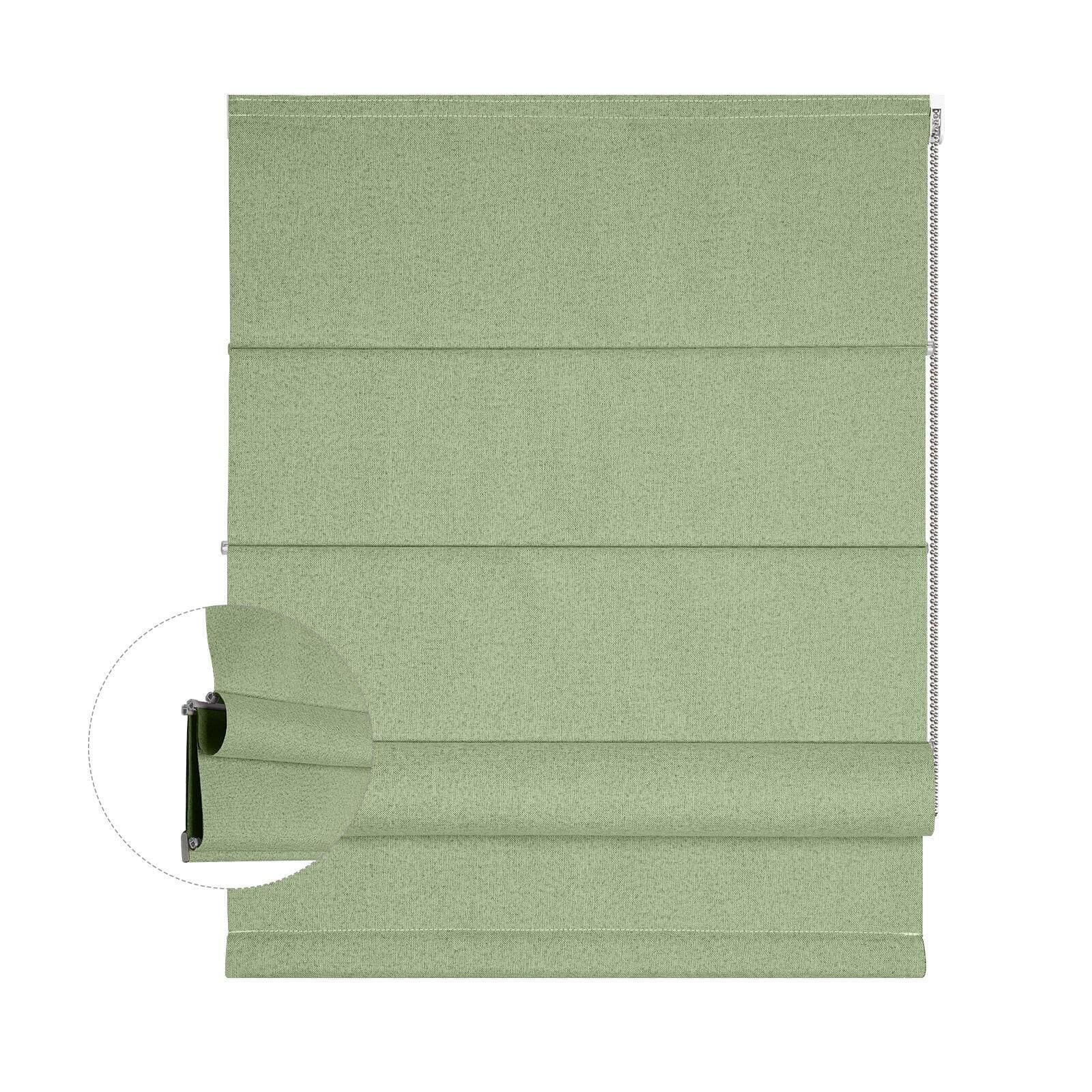

Explore our full range of 👉 Roman Shades

Detailed Rate Table

| Source Country | US Tariff Rate (2025) | EU MFN Rate (HS 6303.92) |

|---|---|---|

| China | 11.3% - 25% (HTS 6303.92.2030) | 6.9% - 12% |

| EU (Poland, Italy, Germany) | 10% - 25% depending on product/material | n/a |

| Vietnam, S. Korea | 6% - 12% | 6.9% - 12% |

| US-made | 0% | -- |

- US Customs allows for duty reduction when US-origin raw materials are reimported after assembly abroad (see HTS 9802.00.80). However, most finished blinds sourced from China or Europe are taxed on the full value unless significant US inputs are documented.

- Local US manufacturing is difficult for many project-grade shades, since core components (motors, fabrics, clutches) are rarely made entirely domestically.

How can importers minimize tariff impact on blind procurement[^3]?

The right strategies can soften or sidestep tariff shocks for project buyers.

Importers can mitigate tariff costs by diversifying suppliers to low-tariff countries, using HS code reclassification, taking advantage of US/EU trade agreements, or negotiating with suppliers for delivered duty-paid (DDP) terms. Working with experienced brokers and demanding transparent cost breakdowns reduces surprises and maximizes savings.

Explore our full range of 👉 Shangri-la Shades

Actionable Strategies

-

Diversify Sourcing

- Mix orders from both US and low-tariff partners (Vietnam, South Korea, domestic OEMs).

- Don’t rely solely on China or EU, especially for large-scale jobs.

-

HS Code Classification

- Properly classify by material/usage; some technical blinds and shade types have lower rates.

- Invest in compliant documentation; incorrect codes can lead to high, retroactive tariffs.

-

Free Trade Agreements and FTZs

- Use FTAs to lower duties (e.g., USMCA for US-Mexico-Canada buyers).

- Store inventory in bonded warehouses or Free Trade Zones to delay tariffs until final destination.

-

Supplier Negotiation and DDP

- Negotiate for DDP (Delivered Duty Paid) terms, shifting tariff burden to supplier—though at higher list prices.

- Work with established brokers familiar with evolving trade rules and who provide transparent cost sheets.

-

Tariff Engineering

- Source or specify components with low-tariff countries of origin.

- Modify designs to require less high-tariff content or to leverage local assembly.

| Mitigation Method | Reduction Potential | Complexity | Best For |

|---|---|---|---|

| Country Diversification | Moderate-High | Moderate | Medium & large buyers |

| HS Code Optimization | High (per product) | High | Custom/volume importers |

| Bonded Warehousing/FTZ | Delay only | Moderate-High | Long-cycle/seasonal importers |

| DDP Terms | Variable | Low | Smaller/new importers |

What are the long-term impacts of blind tariffs on supply chains?

The wave of tariffs on blinds is doing more than just raising prices—it is fundamentally changing how, where, and from whom project buyers can source large window covering projects.

Long-term, blind tariffs are driving supply chain restructuring, market consolidation, increased operational costs, and a gradual shift in global sourcing strategies, with some movement toward US or regional assembly, but few signs of fully domestic supply chains for advanced blinds products.

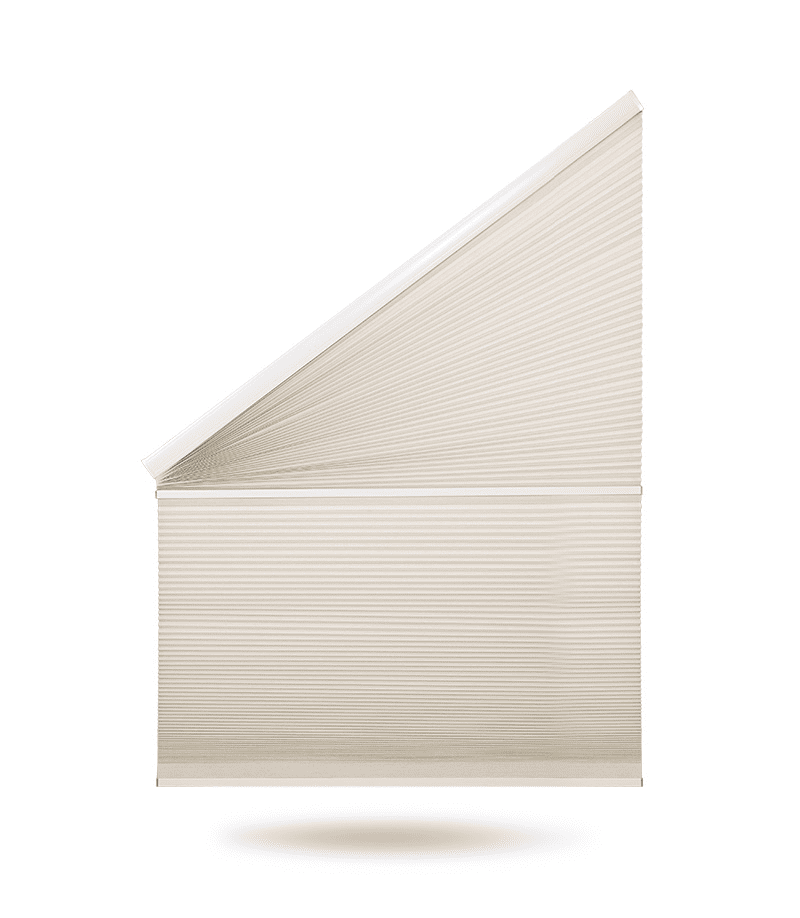

Explore our full range of 👉 Honeycomb Blinds

Long-Term Effects and Buyer Implications

- Supply Chain Restructuring: Large brands and some buyers are moving sourcing out of China to Vietnam, South Korea, and other low-tariff countries. But component-level reliance on China/EU remains high, especially for motors and specialty fabrics.

- Market Consolidation: Small or niche blinds manufacturers, less able to absorb new costs, are being acquired or dropping out. This has led to fewer choices for buyers, especially in custom and innovation-rich shade categories.

- Administrative Burden: Both importers and project managers face rising legal and compliance costs, new documentation and registration steps, and mounting audit risks.

- Price Stickiness: Even if tariffs are later relaxed, the cost increases (in materials, logistics, admin) may be slow to subside. US-based blinds factories cannot yet fully replace offshore production for variety, performance, or price.

- Design and Innovation: Pressure to cut costs may hinder innovation, reducing new fabric options and limiting advanced motorization unless suppliers can command higher margins.

| Supply Chain Factor | Pre-Tariff | 2025+ Trend | Buyer Considerations |

|---|---|---|---|

| Country Sourcing | China heavy | Diversify to Asia, some US | Watch for vendor reliability |

| Brand Landscape | Many small brands | Fewer, larger players | Confirm supply chain strength |

| Lead Times | Predictable | More delays, uncertainty | Buffer project schedules |

| Innovation | High | More cost-focused | Fewer fabric/motor upgrades |

How do tariff surcharges affect end-customer pricing?

In practice, almost every new round of tariffs gets reflected in resale prices. If you’ve been quoted for a blinds project in 2024 or 2025, you’ve probably seen line-item “tariff surcharges” of 8–15% or even higher on your bid or invoice.

Tariff surcharges directly raise the final price paid by the end customer, with most of the tariff increase being passed through the supply chain as either a transparent line item or as an embedded higher retail cost.

Pricing Chain Example

- Manufacturers introduce a 0–15% surcharge in response to tariffs, which gets added to the base invoice to dealers/contractors.

- Dealers typically pass this on in proposals, showing it transparently or embedding it in the retail sticker price.

- Average retail increases for both custom and ready-made blinds are running 6–15% above last year, driven mostly by import tariff pass-through and some by rising logistics/admin costs.

Transparent breakdowns are now common, and some large retail brands use visible line items for tariffs, installation, and shipping to reduce “junk fees” and avoid regulatory scrutiny.

| Stage | Cost Pass-Through |

|---|---|

| Manufacturer to Dealer | 80–100% |

| Dealer to Customer | 80–100% |

| Resulting Retail Change | +8–15% typical |

Action step: Always demand itemized proposals showing tariff, shipping, and installation separately so you can spot and negotiate cost elements directly.

Conclusion

Tariffs on blinds are here to stay, raising import costs 8–25%, squeezing margins, and pushing buyers to rethink sourcing, pricing, and project planning. Strategic adaptation is now a must.

Extended FAQ Section

What is the exact US import duty on blinds from China and Europe in 2025?

The US currently imposes an 11.3%–25% duty on finished blinds/shades imported from China, under HTS code 6303.92.2030. European blinds typically face 10%–25% duties depending on material and product structure, with most surcharges fully passed through to the importer or buyer. Rates change frequently, so always confirm with CBP or your broker at time of order.

Table: Common Tariff Rates

| Country | Product | Typical 2025 US Tariff |

|---|---|---|

| China | Synthetic blinds | 11.3%–25% |

| Europe | Roller/Honeycomb | 10%-25% |

| Vietnam | Roller blinds | 6%-12% |

| US-local | All | 0% |

For blended products, duties are assessed on the full landed value, except where US-origin material rules apply (HTS 9802.00.80).

How can buyers reduce tariff risk when sourcing blinds for a big project?

Diversify your supplier base to include US and low-tariff country partners, ensure correct HS code classification for every line item, negotiate for DDP terms with your suppliers, use bonded warehouses or FTZs where possible, and work with customs brokers to optimize paperwork. For large projects, split shipments or stagger orders to spread risk and adjust quickly to new policy changes.

Mitigation Checklist

- Confirm every component HS code before issuing a PO.

- Ask suppliers for country-of-origin certificates.

- Request delivered duty-paid quotes for clear comparison.

- Consider partial assembly in tariff-exempt zones for complex jobs.

- Monitor trade policy announcements and adapt sourcing regularly.

Will tariffs keep blinds prices high even if supply chains adjust?

Yes, higher tariffs create a structural floor under costs. Even if buyers shift to suppliers outside China/EU, manufacturing and material costs in alternative regions are usually higher. Added admin, compliance, and logistical expenses persist after policy changes. Even if tariffs drop, prices will not likely return to pre-2020 levels, as new supply chain structures and consolidation lock in higher cost bases.

Key Factors Keeping Prices High:

- Global wages/logistics inflation

- Concentration of large suppliers and less competition

- Ongoing documentation and compliance costs

- Retention of “tariff line items” even after formal policy rollback

Ready to protect your margins and control tariff exposure on your next blinds project? Request a custom, itemized quote from VelaBlinds with full duty breakdowns, country-of-origin detail, and supply options tailored to your project specs. For fast project analysis and specs, contact info@velablinds.com.

---

[^1]: Understanding the factors influencing window blind import costs can help you make informed sourcing decisions and protect your margins.

[^2]: Exploring tariff rates can provide insights into potential cost implications and help you strategize your procurement effectively.

[^3]: Discovering strategies to minimize tariff impacts can lead to significant savings and better project pricing for buyers and contractors.Partner with VelaBlinds for Your Next Project

Smart window treatments shouldn't be complicated. After working with 500+ distributors and contractors worldwide, I've streamlined the process to get you quality products, competitive pricing, and reliable support - every time.

Why project professionals choose VelaBlinds:

- ✅ Fast, Accurate Quotes - Detailed specs and pricing within 24 hours

- ✅ Transparent Pricing - No hidden fees, volume discounts clearly outlined

- ✅ Quality Assurance - Direct partnerships with certified OEM manufacturers

- ✅ Project Support - Dedicated account manager from quote to delivery

Start your next project:

📧 Quick Quote: Send your requirements to info@velablinds.com

📱 Direct Contact: WhatsApp +86 137 2012 8317

🌐 Browse Solutions: https://velablinds.com/

📁 Product Resources: Access spec sheets, catalogs & project files

Jimmy Chen, Founder

"I built VelaBlinds to solve the real challenges I faced as a project buyer - long lead times, unclear specs, and unreliable suppliers. Let's discuss how we can power your projects with smarter blinds."

Serving distributors and contractors across North America, Europe, and Australia since 2018.